Losing a loved one is never easy, and during such emotional times, managing financial matters can feel overwhelming. One of the important tasks that need to be addressed is claiming the funds or closing the bank account of the deceased. A Death Claim Letter is a crucial document that allows the nominee, legal heir, or authorized representative to formally request the bank to release the funds or transfer them to the rightful beneficiary.

If you’re searching for the correct death claim letter format for the bank, this guide will help you navigate the process smoothly. Whether you’re a family member or a legal representative, we’ve compiled 06+ sample templates that will provide you with the right structure and language needed to submit a clear, well-drafted letter. This article will also guide you through the essential documents, how to address the bank, and the key points to ensure your claim is processed without delays.

Let’s make the process of submitting a death claim letter to the bank as straightforward as possible, so you can focus on what matters during this difficult time.

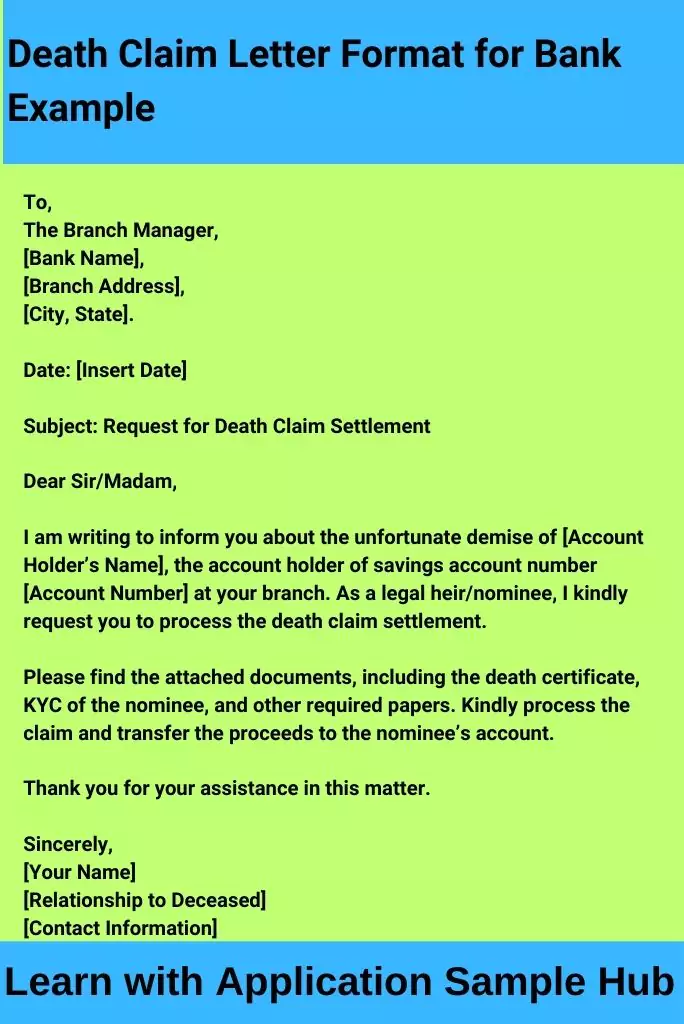

Death Claim Letter Format for Bank Example

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State].

Date: [Insert Date]

Subject: Request for Death Claim Settlement

Dear Sir/Madam,

I am writing to inform you about the unfortunate demise of [Account Holder’s Name], the account holder of your branch’s savings account number [Account Number]. As a legal heir/nominee, I kindly request you process the death claim settlement.

Please find the attached documents, including the death certificate, the nominee’s KYC, and other required papers. Kindly process the claim and transfer the proceeds to the nominee’s account.

Thank you for your assistance in this matter.

Sincerely,

[Your Name]

[Relationship to Deceased]

[Contact Information]

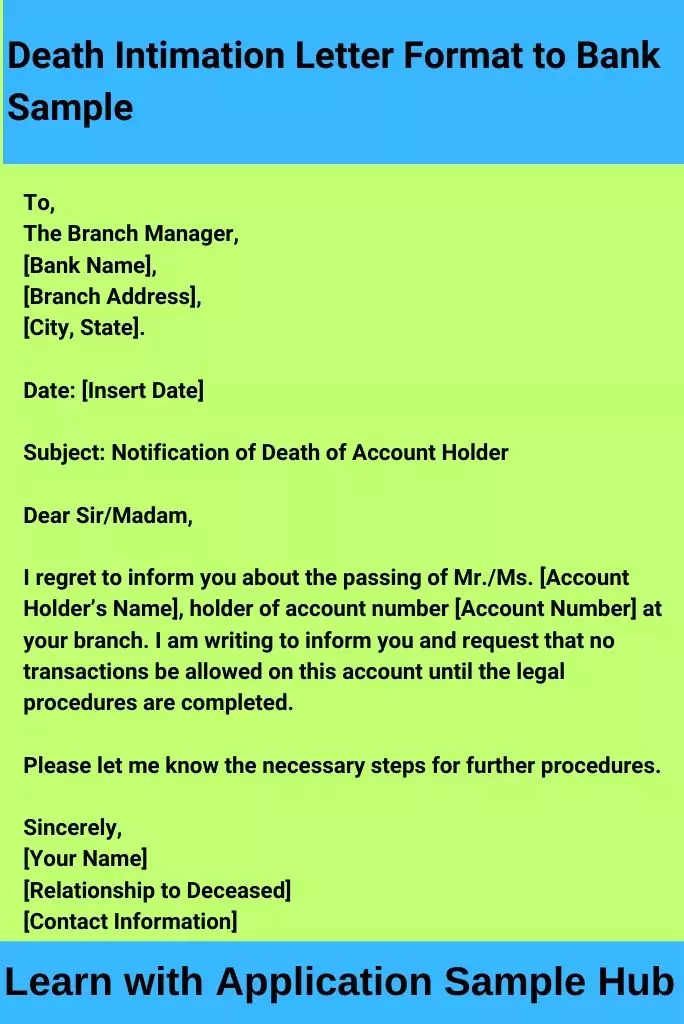

Death Intimation Letter Format to Bank Sample

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State].

Date: [Insert Date]

Subject: Notification of Death of Account Holder

Dear Sir/Madam,

I regret to inform you about the passing of Mr./Ms. [Account Holder’s Name], holder of account number [Account Number] at your branch. I am writing to inform you and request that no transactions be allowed on this account until the legal procedures are completed.

Please let me know the necessary steps for further procedures.

Sincerely,

[Your Name]

[Relationship to Deceased]

[Contact Information]

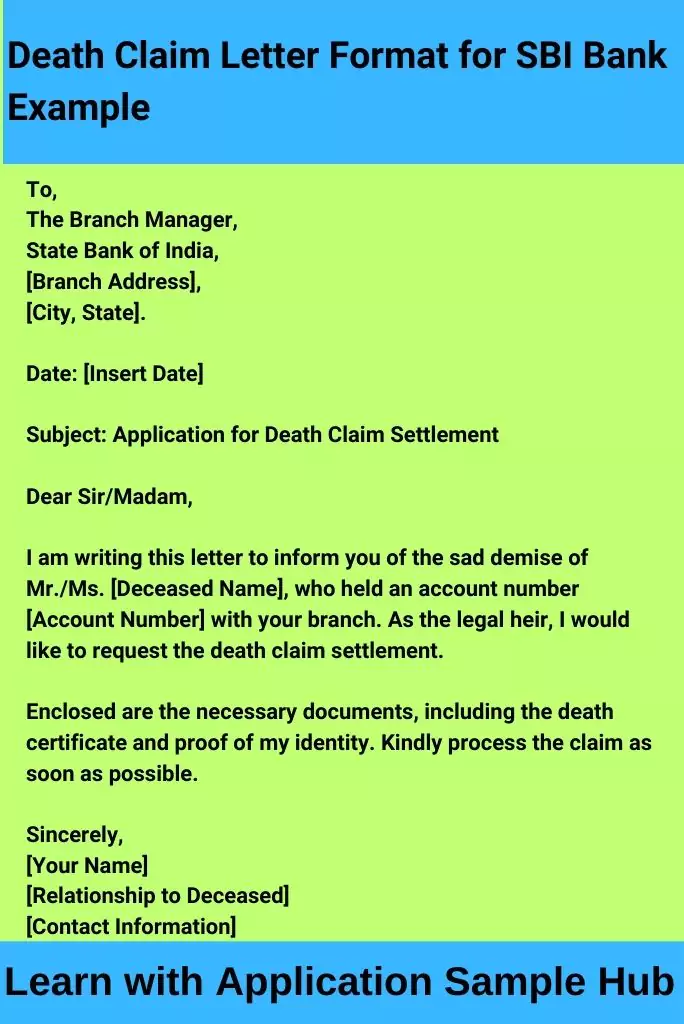

Death Claim Letter Format for SBI Bank Example

To,

The Branch Manager,

State Bank of India,

[Branch Address],

[City, State].

Date: [Insert Date]

Subject: Application for Death Claim Settlement

Dear Sir/Madam,

I am writing this letter to inform you of the sad demise of Mr./Ms. [Deceased Name], who held an account number [Account Number] with your branch. As the legal heir, I would like to request the death claim settlement.

Enclosed are the necessary documents, including the death certificate and proof of my identity. Kindly process the claim as soon as possible.

Sincerely,

[Your Name]

[Relationship to Deceased]

[Contact Information]

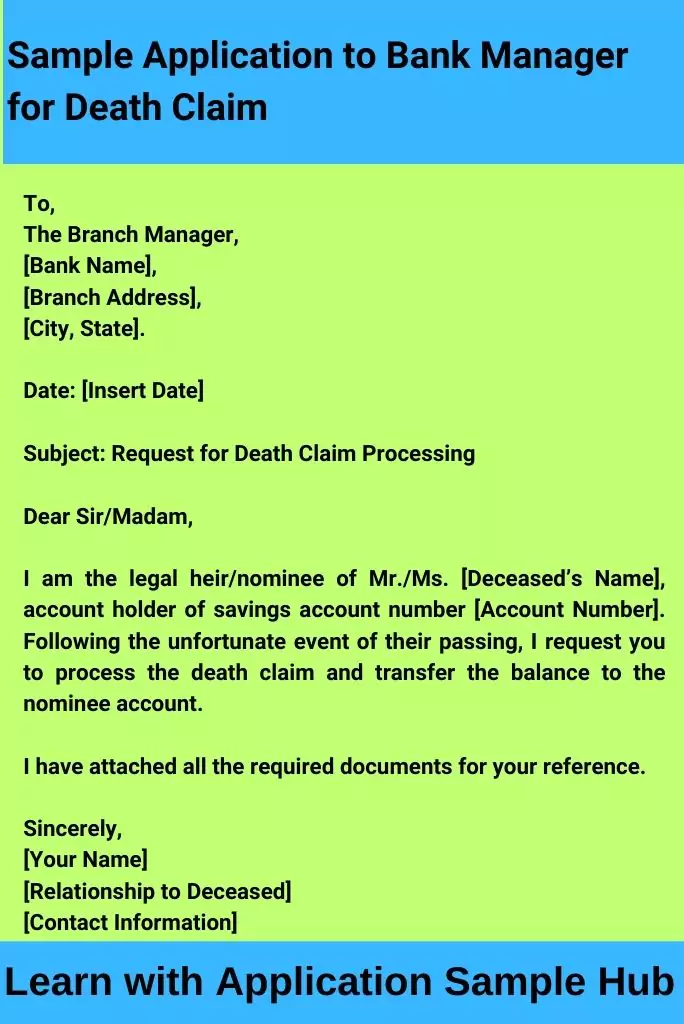

Sample Application to Bank Manager for Death Claim

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State].

Date: [Insert Date]

Subject: Request for Death Claim Processing

Dear Sir/Madam,

I am the legal heir/nominee of Mr./Ms. [Deceased’s Name], account holder of savings account number [Account Number]. Following their passing, I request you to process the death claim and transfer the balance to the nominee account.

I have attached all the required documents for your reference.

Sincerely,

[Your Name]

[Relationship to Deceased]

[Contact Information]

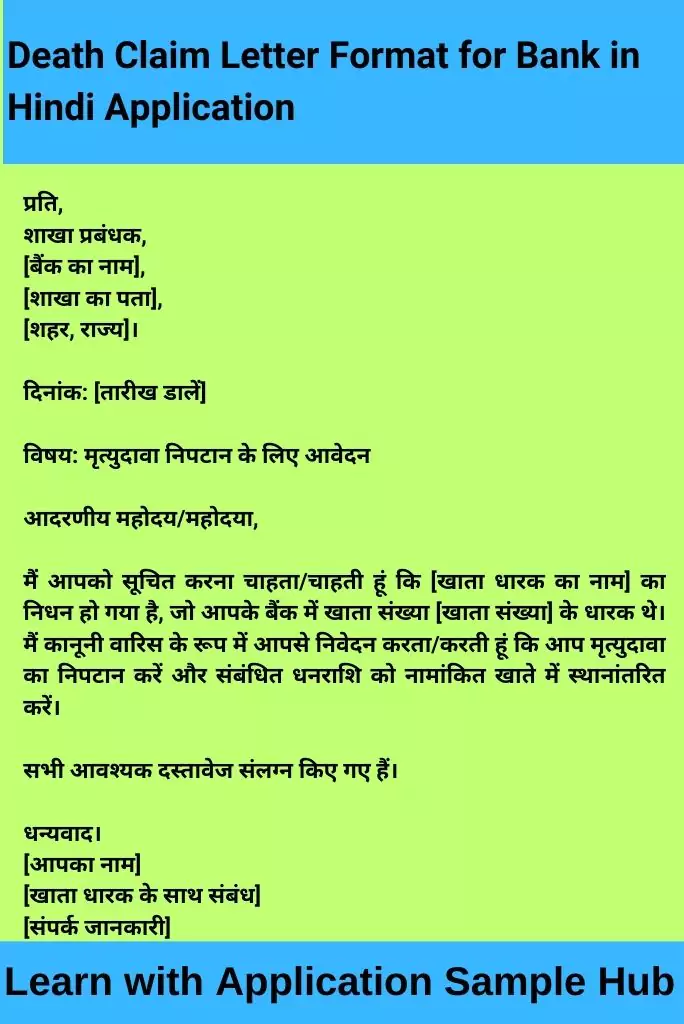

Death Claim Letter Format for Bank in Hindi Application

प्रति,

शाखा प्रबंधक,

[बैंक का नाम],

[शाखा का पता],

[शहर, राज्य]।

दिनांक: [तारीख डालें]

विषय: मृत्युदावा निपटान के लिए आवेदन

आदरणीय महोदय/महोदया,

मैं आपको सूचित करना चाहता/चाहती हूं कि [खाता धारक का नाम] का निधन हो गया है, जो आपके बैंक में खाता संख्या [खाता संख्या] के धारक थे। मैं कानूनी वारिस के रूप में आपसे निवेदन करता/करती हूं कि आप मृत्युदावा का निपटान करें और संबंधित धनराशि को नामांकित खाते में स्थानांतरित करें।

सभी आवश्यक दस्तावेज संलग्न किए गए हैं।

धन्यवाद।

[आपका नाम]

[खाता धारक के साथ संबंध]

[संपर्क जानकारी]

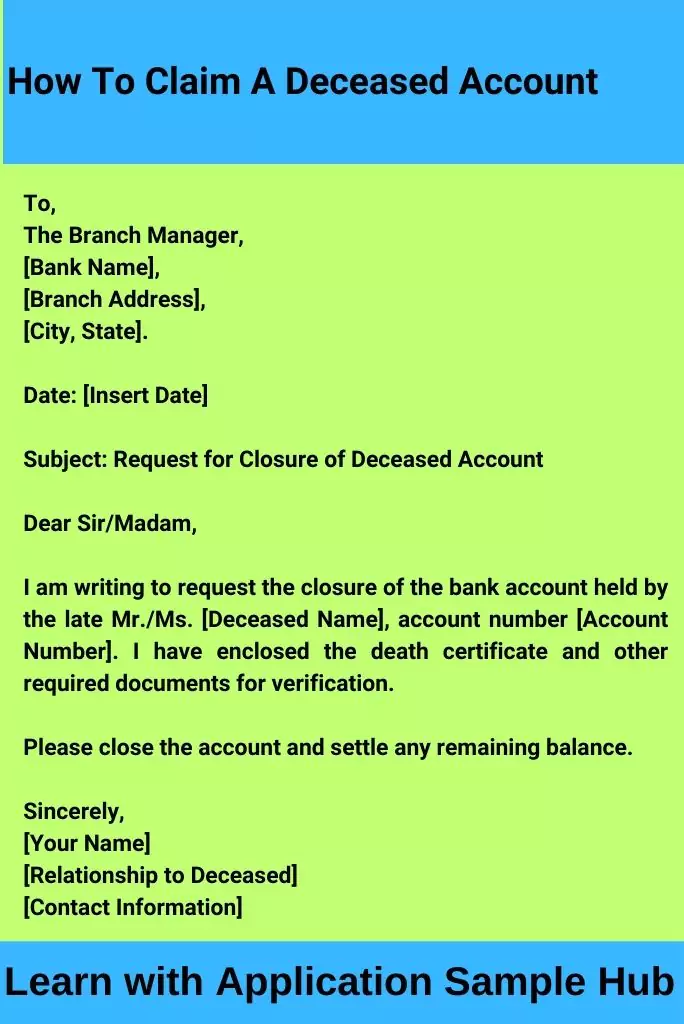

How To Claim A Deceased Account

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City, State].

Date: [Insert Date]

Subject: Request for Closure of Deceased Account

Dear Sir/Madam,

I am writing to request the closure of the bank account held by the late Mr./Ms. [Deceased Name], account number [Account Number]. I have enclosed the death certificate and other required documents for verification.

Please close the account and settle any remaining balance.

Sincerely,

[Your Name]

[Relationship to Deceased]

[Contact Information]

How Do I Write an Application for a Death Claim?

When writing a death claim application for a bank, the process involves a few key steps. Follow these guidelines:

- Address the Bank Manager – Clearly state the bank’s branch and address.

- State the Purpose – Mention the reason for writing the letter, i.e., to request the death claim settlement.

- Include Account Details – Provide the deceased’s account number and your relationship to the deceased.

- Attach Required Documents – These include the death certificate, nominee ID proof, and any legal heir documents.

- Request Action – Politely ask for the claim to be processed.

- Provide Contact Information – Ensure your contact details are correct for follow-up.

Components of a Proper Application

When writing a death claim letter to a bank, ensure your application contains the following key elements:

- Bank Manager’s Address – Start with the branch and manager details.

- Clear Subject Line – Example: “Request for Death Claim Settlement.”

- Account Holder Information – Include the deceased’s account number and name.

- Supporting Documents – Attach the death certificate and any legal documentation.

- Request for Action – Politely ask for the claim to be processed or the account closed.

- Contact Information – Include your full name, relationship to the deceased, and contact details.

Structuring the Proper Application Effectively

To ensure your application is processed quickly, structure it as follows:

- Salutation – Address the branch manager.

- Subject – Clearly state your request for a death claim settlement.

- Body of the Letter – Introduce yourself, mention the deceased’s account details, and request action.

- Supporting Documents – Indicate that you’ve attached the necessary documentation.

- Closing – Sign off with your name, relationship to the deceased, and contact information.

FAQs

What is a Death Claim Letter for a Bank?

A death claim letter is a formal request submitted to a bank to claim the funds of a deceased account holder. This letter is typically sent by the legal heirs, beneficiaries, or nominees of the deceased person to initiate the process of transferring the funds from the account.

Who can write a death claim letter to the bank?

The letter can be written by:

- The nominee listed on the bank account

- The legal heir(s) of the deceased

- An executor of the deceased’s will

- A legal representative with a court order, if no nominee or will is present

What information should be included in a death claim letter?

The letter should include:

- The name of the deceased account holder

- Account number(s) held by the deceased

- The claimant’s relationship to the deceased

- A request for the release of funds or closure of the account

- Any supporting documents (death certificate, identity proof, legal heir certificate, etc.)

What documents are required when submitting a death claim to the bank?

Typically, the following documents are required:

- A copy of the death certificate

- Proof of identity of the claimant(s)

- Bank account details of the deceased

- Nomination or legal heir certificate (if applicable)

- A copy of the will (if applicable)

- Any court order, if no nominee or will is present

How long does the process take after submitting a death claim letter?

The processing time may vary depending on the bank, but typically it takes around 7-15 business days after all the necessary documents have been submitted and verified.

Can multiple claimants apply for a death claim at the same time?

Yes, if there are multiple legal heirs or beneficiaries, they can jointly submit a claim. The bank will usually distribute the funds according to the will, court order, or applicable inheritance laws.

Is it mandatory to have a nominee on the account to claim funds?

No, if there is no nominee on the account, the legal heirs can claim the funds. In such cases, the bank may require additional documents, such as a succession certificate or legal heir certificate, depending on local laws.

What happens if there is a dispute between the heirs over the death claim?

If there is a dispute between heirs, the bank may require a court order or legal resolution before releasing the funds. The bank will not release the funds until the matter is settled legally.

Can a lawyer or legal representative write a death claim letter on behalf of the heirs?

Yes, a lawyer or legal representative can write the letter on behalf of the heirs, provided they have the necessary legal authority, such as a power of attorney or court order.

Can I claim funds from a joint account after one account holder’s death?

In the case of a joint account, if the account is held with a “survivorship” clause, the surviving account holder(s) can automatically claim the funds. If there is no such clause, the bank will follow the normal death claim process.