In today’s fast-paced digital world, banking transactions are often completed within seconds. While this efficiency is beneficial, it also means that mistakes can occur just as quickly if you find yourself in a situation where a transaction has gone awry whether due to a wrong transfer, an incorrect amount, or a failed transaction, you may need to apply to your bank to rectify the error.

In this comprehensive guide, we’ll explore how to write an effective application to the bank for a wrong transaction, along with several sample formats and answers to frequently asked questions.

Why Is It Important to Address Wrong Transactions Promptly?

Mistakes in banking transactions can have significant consequences. Whether it’s a wrong account transfer or an erroneous UPI payment, these errors can affect your financial standing and peace of mind. Addressing these issues promptly helps ensure that your money is restored to the correct account and that your banking records remain accurate.

When you need to alert your bank about a wrong transaction, the first step is to draft a formal application. This should be concise yet detailed enough to allow the bank to quickly understand and resolve the issue. Below is a sample application format for your reference.

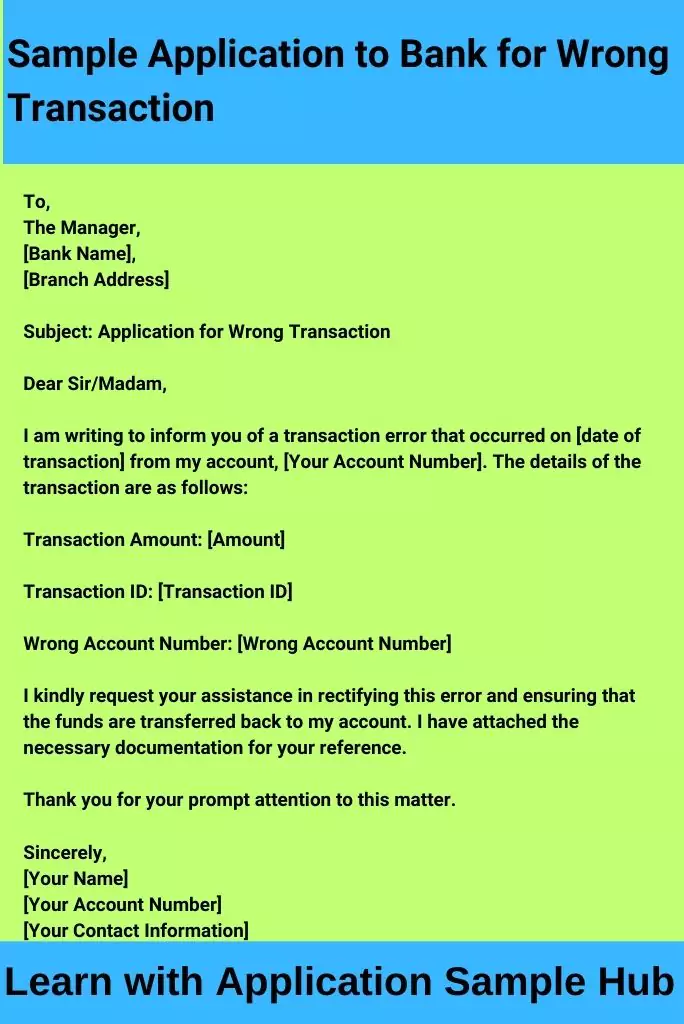

Sample Application to Bank for Wrong Transaction

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Application for Wrong Transaction

Dear Sir/Madam,

I am writing to inform you of a transaction error that occurred on [date of transaction] from my account, [Your Account Number]. The details of the transaction are as follows:

- Transaction Amount: [Amount]

- Transaction ID: [Transaction ID]

- Wrong Account Number: [Wrong Account Number]

I kindly request your assistance in rectifying this error and ensuring that the funds are transferred back to my account. I have attached the necessary documentation for your reference.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Account Number]

[Your Contact Information]

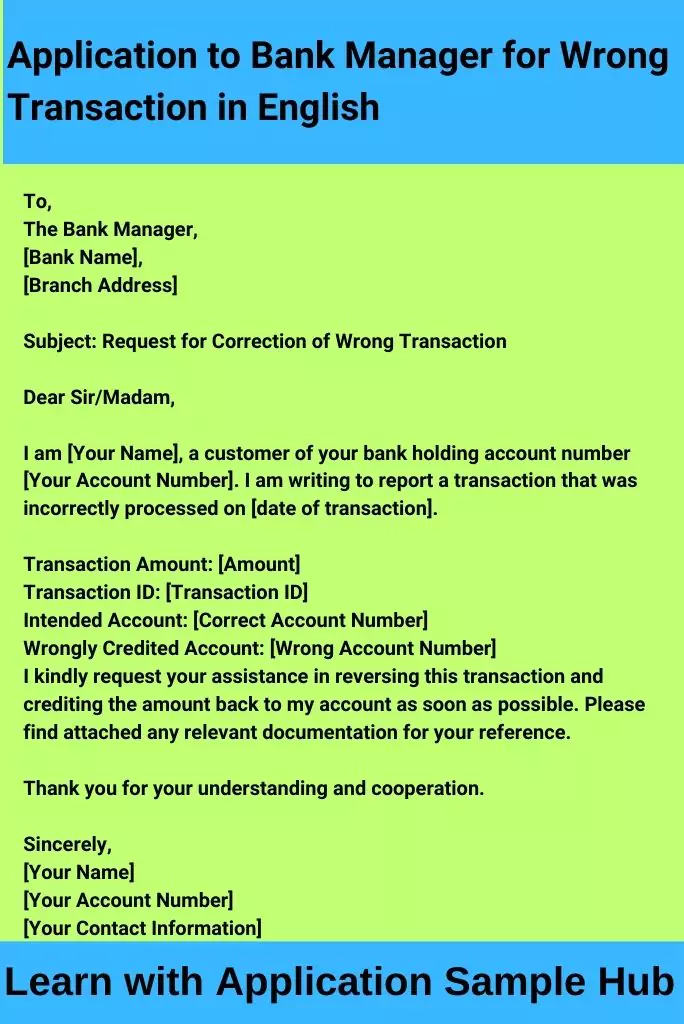

Application to Bank Manager for Wrong Transaction in English

To,

The Bank Manager,

[Bank Name],

[Branch Address]

Subject: Request for Correction of Wrong Transaction

Dear Sir/Madam,

I am [Your Name], a customer of your bank holding account number [Your Account Number]. I am writing to report a transaction that was incorrectly processed on [date of transaction].

- Transaction Amount: [Amount]

- Transaction ID: [Transaction ID]

- Intended Account: [Correct Account Number]

- Wrongly Credited Account: [Wrong Account Number]

I kindly request your assistance in reversing this transaction and crediting the amount back to my account as soon as possible. Please find attached any relevant documentation for your reference.

Thank you for your understanding and cooperation.

Sincerely,

[Your Name]

[Your Account Number]

[Your Contact Information]

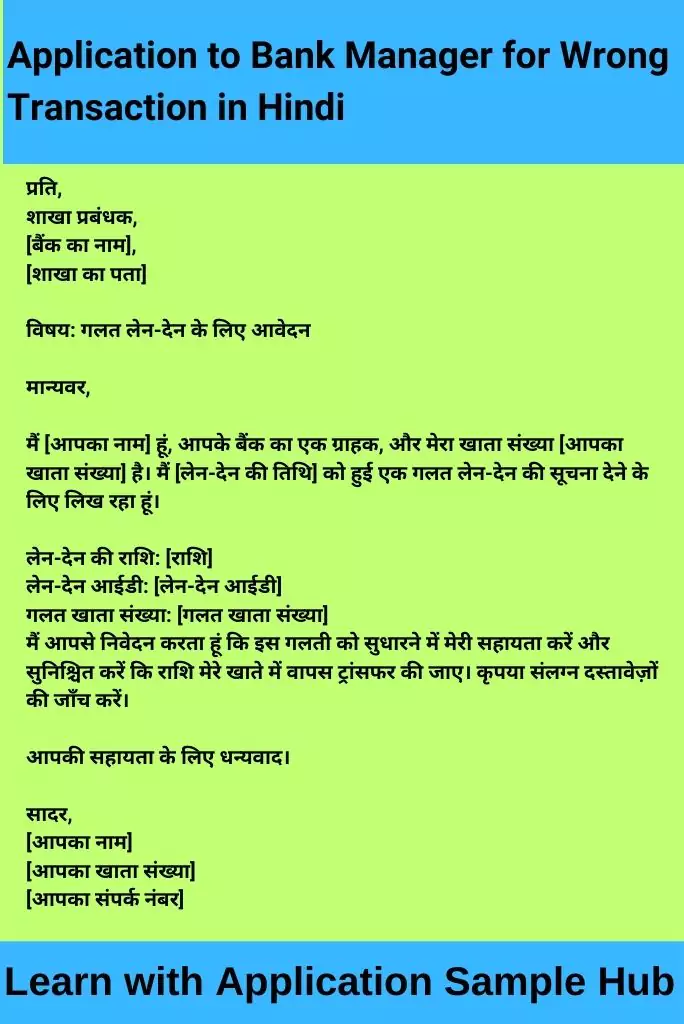

Application to Bank Manager for Wrong Transaction in Hindi

प्रति,

शाखा प्रबंधक,

[बैंक का नाम],

[शाखा का पता]

विषय: गलत लेन-देन के लिए आवेदन

मान्यवर,

मैं [आपका नाम] हूं, आपके बैंक का एक ग्राहक, और मेरा खाता संख्या [आपका खाता संख्या] है। मैं [लेन-देन की तिथि] को हुई एक गलत लेन-देन की सूचना देने के लिए लिख रहा हूं।

- लेन-देन की राशि: [राशि]

- लेन-देन आईडी: [लेन-देन आईडी]

- गलत खाता संख्या: [गलत खाता संख्या]

मैं आपसे निवेदन करता हूं कि इस गलती को सुधारने में मेरी सहायता करें और सुनिश्चित करें कि राशि मेरे खाते में वापस ट्रांसफर की जाए। कृपया संलग्न दस्तावेज़ों की जाँच करें।

आपकी सहायता के लिए धन्यवाद।

सादर,

[आपका नाम]

[आपका खाता संख्या]

[आपका संपर्क नंबर]

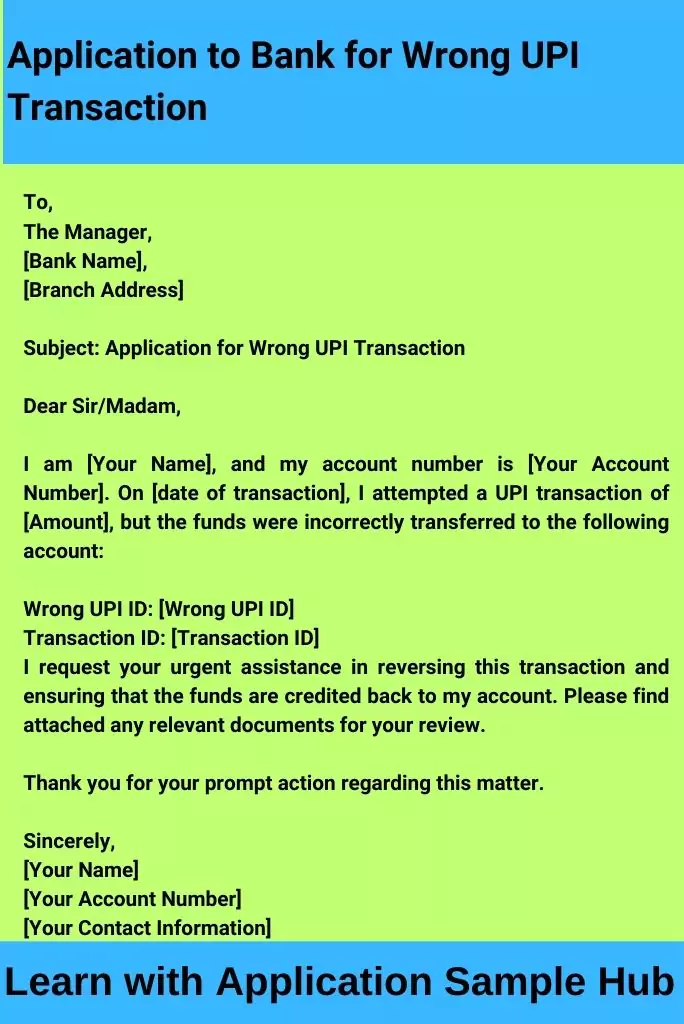

Application to Bank for Wrong UPI Transaction

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Application for Wrong UPI Transaction

Dear Sir/Madam,

I am [Your Name], and my account number is [Your Account Number]. On [date of transaction], I attempted a UPI transaction of [Amount], but the funds were incorrectly transferred to the following account:

- Wrong UPI ID: [Wrong UPI ID]

- Transaction ID: [Transaction ID]

I request your urgent assistance in reversing this transaction and ensuring that the funds are credited back to my account. Please find attached any relevant documents for your review.

Thank you for your prompt action regarding this matter.

Sincerely,

[Your Name]

[Your Account Number]

[Your Contact Information]

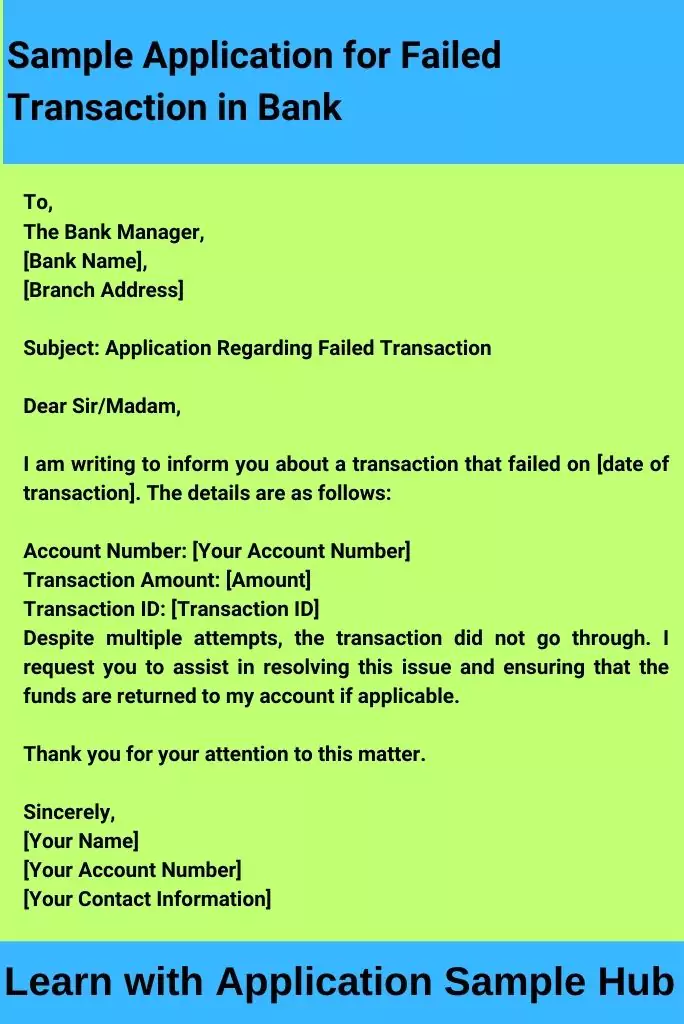

Sample Application for Failed Transaction in Bank

To,

The Bank Manager,

[Bank Name],

[Branch Address]

Subject: Application Regarding Failed Transaction

Dear Sir/Madam,

I am writing to inform you about a transaction that failed on [date of transaction]. The details are as follows:

- Account Number: [Your Account Number]

- Transaction Amount: [Amount]

- Transaction ID: [Transaction ID]

Despite multiple attempts, the transaction did not go through. I request you to assist in resolving this issue and ensuring that the funds are returned to my account if applicable.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Account Number]

[Your Contact Information]

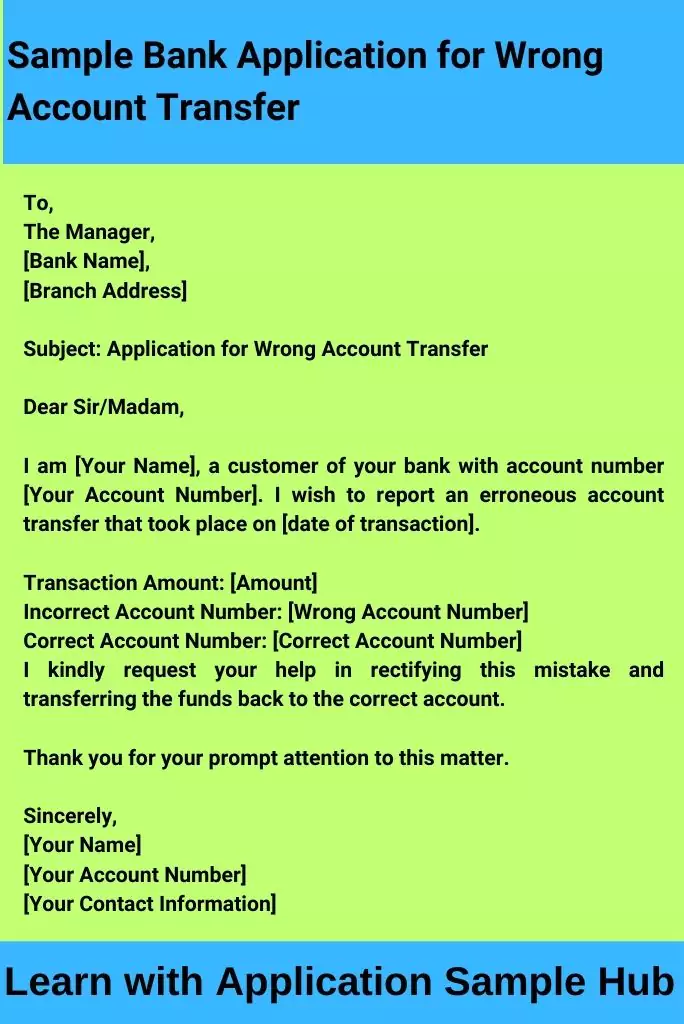

Sample Bank Application for Wrong Account Transfer

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Application for Wrong Account Transfer

Dear Sir/Madam,

I am [Your Name], a customer of your bank with account number [Your Account Number]. I wish to report an erroneous account transfer that took place on [date of transaction].

- Transaction Amount: [Amount]

- Incorrect Account Number: [Wrong Account Number]

- Correct Account Number: [Correct Account Number]

I kindly request your help in rectifying this mistake and transferring the funds back to the correct account.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Account Number]

[Your Contact Information]

How to Write an Application to a Bank Manager for the Wrong Transaction

To write an effective application for a wrong transaction, follow these steps:

- Use the Correct Format: Always begin with the bank’s address and your contact information.

- State Your Purpose: Clearly mention the reason for writing the application in the subject line.

- Provide Details: Include relevant information such as transaction amounts, account numbers, and dates.

- Request Action: Politely ask the bank to rectify the issue or provide assistance.

- Be Polite and Concise: Maintain a respectful tone throughout your application.

Components of a Proper Application

A well-structured application to the bank should include the following components:

- Addressing the Bank Manager: Start with the bank manager’s title and the bank’s name.

- Subject Line: Clearly state the purpose of your application.

- Introduction: Briefly introduce yourself and provide your account details.

- Details of the Transaction: Specify the transaction details related to the error.

- Request for Resolution: Clearly state what action you would like the bank to take.

- Closing Statement: Thank the bank for their assistance and sign off with your name and contact information.

Structuring the Proper Application Effectively

To ensure clarity and effectiveness in your application:

- Organize Your Content: Use paragraphs to separate different sections of your application.

- Use Bullet Points: When listing details, consider using bullet points for better readability.

- Be Direct: Get to the point quickly, providing all necessary details without unnecessary embellishments.

- Review and Edit: Always proofread your application to check for grammatical errors or missing information.

FAQs

How long does it take to resolve a wrong transaction issue?

The time taken can vary based on the bank’s policies but generally ranges from 3 to 10 business days.

What documents should I attach with my application?

You may need to attach transaction receipts, account statements, or any other relevant documentation that supports your claim.

Can I submit my application online?

Many banks provide online platforms for submitting complaints and applications. Check your bank’s website for details.

Is there a fee for rectifying a wrong transaction?

Typically, banks do not charge fees for correcting errors made by the bank or due to system failures. However, always verify with your bank’s customer service.

What if my application is denied?

If your application is denied, you can ask for a detailed explanation and consider escalating the matter to higher authorities within the bank.