When you’ve successfully cleared a loan or require official documentation for specific purposes, obtaining a No Objection Certificate (NOC) from your bank becomes essential. This certificate confirms that you’ve repaid your loan in full or the bank has no objection to a particular transaction, such as a vehicle transfer.

In this detailed guide, I’ll explain how to write an application for NOC from the bank, present several sample formats, and cover frequently asked questions regarding the process.

What is a No Objection Certificate (NOC) and Why is it Important?

A NOC is a legal document issued by the bank stating that they have no objections regarding the loan closure or certain financial activities. The most common scenarios for which people seek a NOC from the bank include:

- Loan clearance: An NOC confirms that no outstanding dues remain after repaying a loan.

- Vehicle transfer: When selling or transferring car ownership, banks issue an NOC to confirm loan repayment and allow the transfer.

- Loan foreclosure: If you repay the entire loan amount before the tenure ends, an NOC will confirm that the account is closed.

Without this document, there may be complications in future financial dealings or legalities.

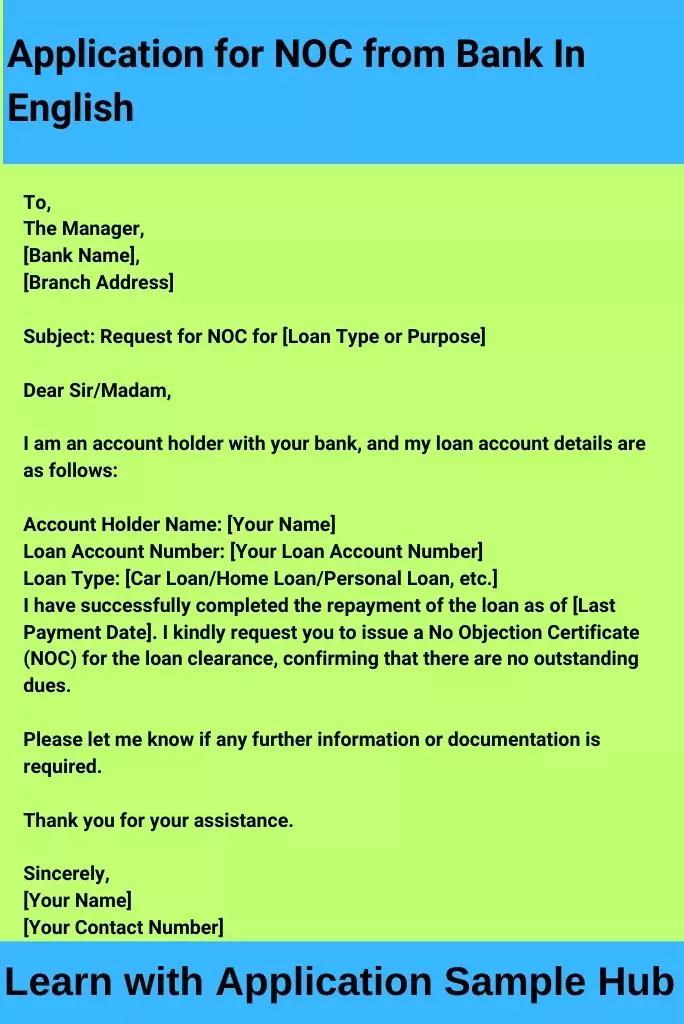

Application for NOC from Bank In English

If you’re looking to draft a formal request in English, here’s a standard template:

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Request for NOC for [Loan Type or Purpose]

Dear Sir/Madam,

I am an account holder with your bank, and my loan account details are as follows:

- Account Holder Name: [Your Name]

- Loan Account Number: [Your Loan Account Number]

- Loan Type: [Car Loan/Home Loan/Personal Loan, etc.]

I have successfully completed the repayment of the loan as of [Last Payment Date]. I kindly request you to issue a No Objection Certificate (NOC) for the loan clearance, confirming that there are no outstanding dues.

Please let me know if any further information or documentation is required.

Thank you for your assistance.

Sincerely,

[Your Name]

[Your Contact Number]

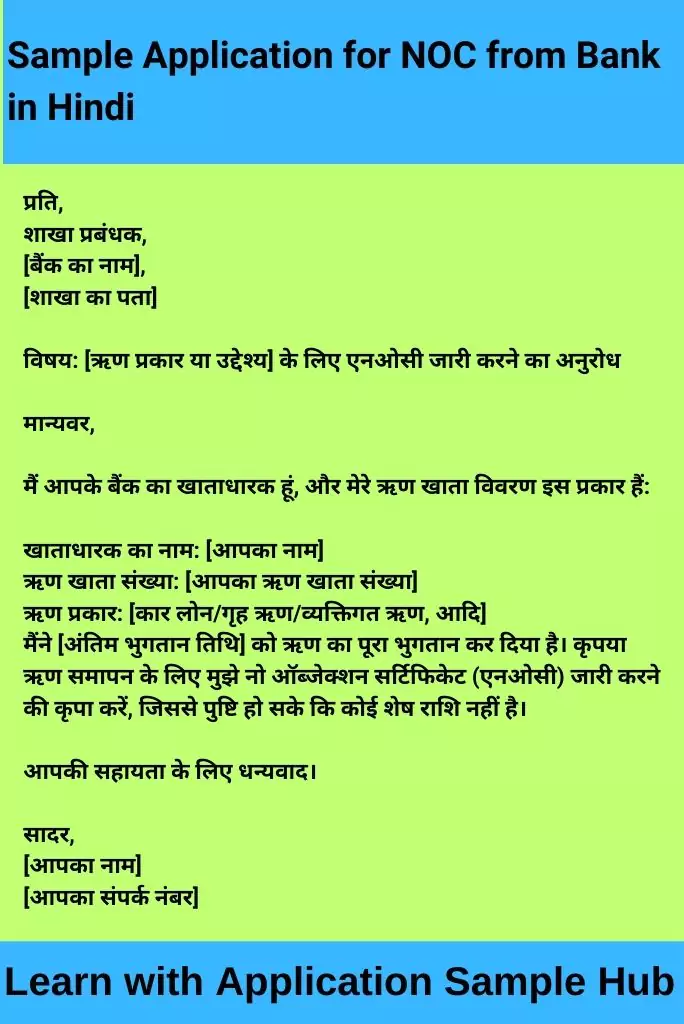

Sample Application for NOC from Bank in Hindi

For those who wish to write their application in Hindi, here’s a simple format:

प्रति,

शाखा प्रबंधक,

[बैंक का नाम],

[शाखा का पता]

विषय: [ऋण प्रकार या उद्देश्य] के लिए एनओसी जारी करने का अनुरोध

मान्यवर,

मैं आपके बैंक का खाताधारक हूं, और मेरे ऋण खाता विवरण इस प्रकार हैं:

- खाताधारक का नाम: [आपका नाम]

- ऋण खाता संख्या: [आपका ऋण खाता संख्या]

- ऋण प्रकार: [कार लोन/गृह ऋण/व्यक्तिगत ऋण, आदि]

मैंने [अंतिम भुगतान तिथि] को ऋण का पूरा भुगतान कर दिया है। कृपया ऋण समापन के लिए मुझे नो ऑब्जेक्शन सर्टिफिकेट (एनओसी) जारी करने की कृपा करें, जिससे पुष्टि हो सके कि कोई शेष राशि नहीं है।

आपकी सहायता के लिए धन्यवाद।

सादर,

[आपका नाम]

[आपका संपर्क नंबर]

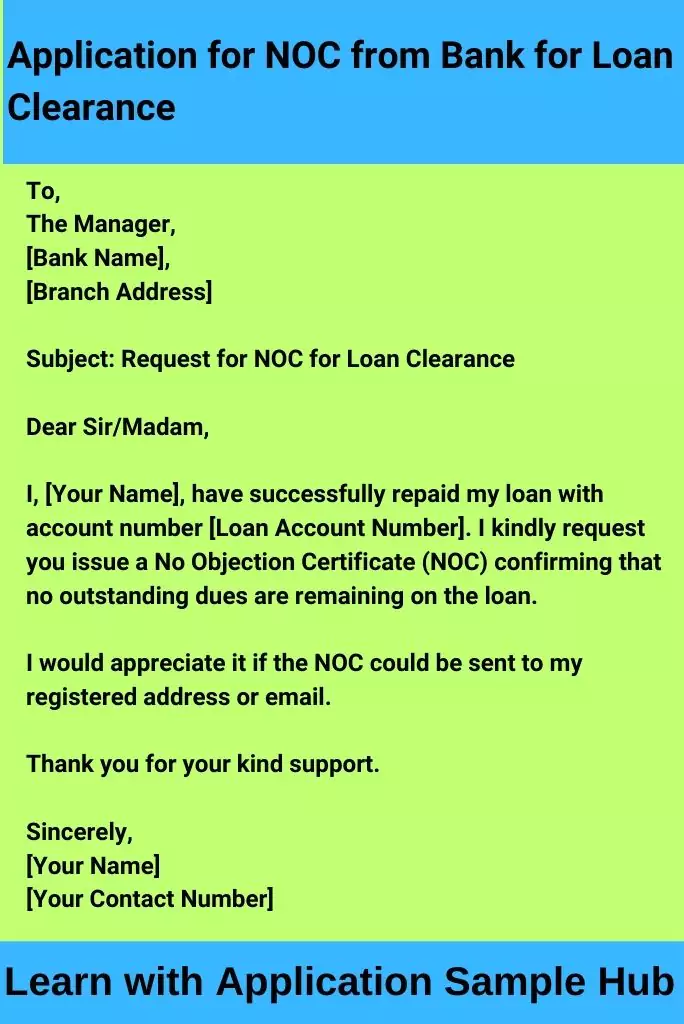

Application for NOC from Bank for Loan Clearance

Once you have cleared your loan, it’s crucial to get an NOC to avoid any future issues. Here’s how to request one for loan clearance:

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Request for NOC for Loan Clearance

Dear Sir/Madam,

I, [Your Name], have successfully repaid my loan with account number [Loan Account Number]. I kindly request you issue a No Objection Certificate (NOC) confirming that no outstanding dues are remaining on the loan.

I would appreciate it if the NOC could be sent to my registered address or email.

Thank you for your kind support.

Sincerely,

[Your Name]

[Your Contact Number]

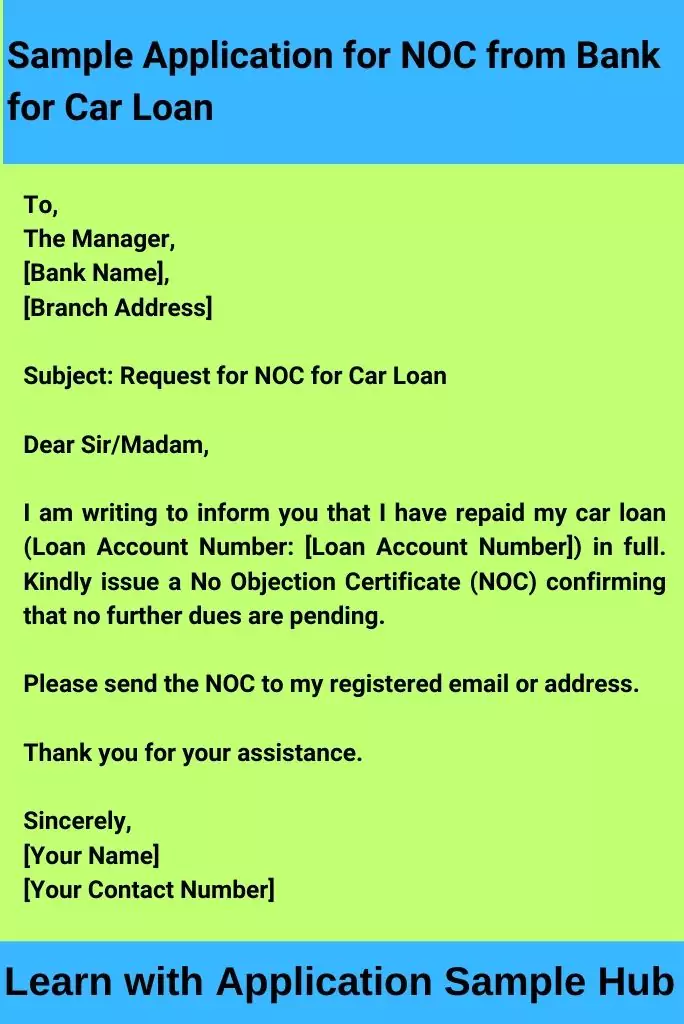

Sample Application for NOC from Bank for Car Loan

If you’ve completed repaying your car loan, you’ll need an NOC from your bank. Here’s a sample format:

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Request for NOC for Car Loan

Dear Sir/Madam,

I am writing to inform you that I have repaid my car loan (Loan Account Number: [Loan Account Number]) in full. Kindly issue a No Objection Certificate (NOC) confirming that no further dues are pending.

Please send the NOC to my registered email or address.

Thank you for your assistance.

Sincerely,

[Your Name]

[Your Contact Number]

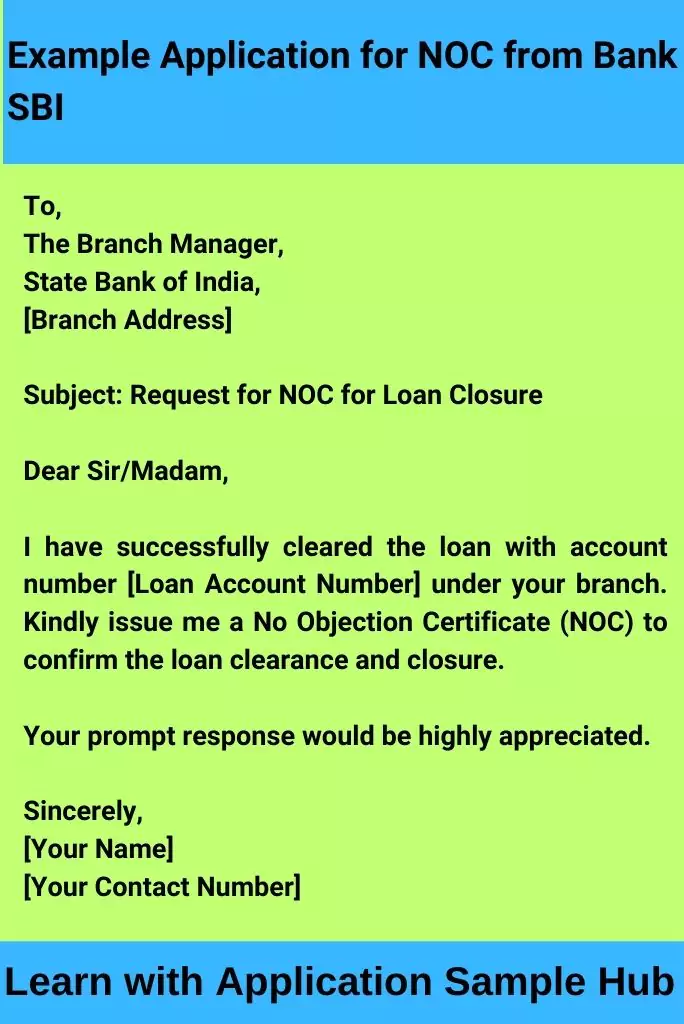

Example Application for NOC from Bank SBI

For customers of the State Bank of India (SBI), here’s an example of an NOC request application:

To,

The Branch Manager,

State Bank of India,

[Branch Address]

Subject: Request for NOC for Loan Closure

Dear Sir/Madam,

I have successfully cleared the loan with account number [Loan Account Number] under your branch. Kindly issue me a No Objection Certificate (NOC) to confirm the loan clearance and closure.

Your prompt response would be highly appreciated.

Sincerely,

[Your Name]

[Your Contact Number]

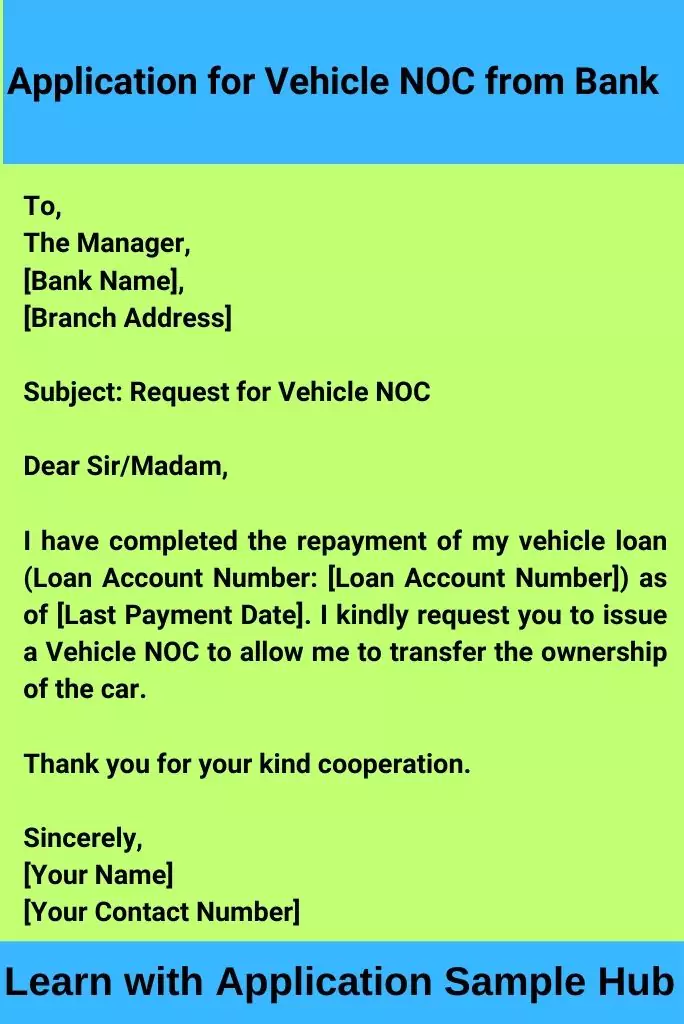

Application for Vehicle NOC from Bank

If you are seeking a NOC specifically for a vehicle, you can modify the application as follows:

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Request for Vehicle NOC

Dear Sir/Madam,

I have completed the repayment of my vehicle loan (Loan Account Number: [Loan Account Number]) as of [Last Payment Date]. I kindly request you to issue a Vehicle NOC to allow me to transfer the ownership of the car.

Thank you for your kind cooperation.

Sincerely,

[Your Name]

[Your Contact Number]

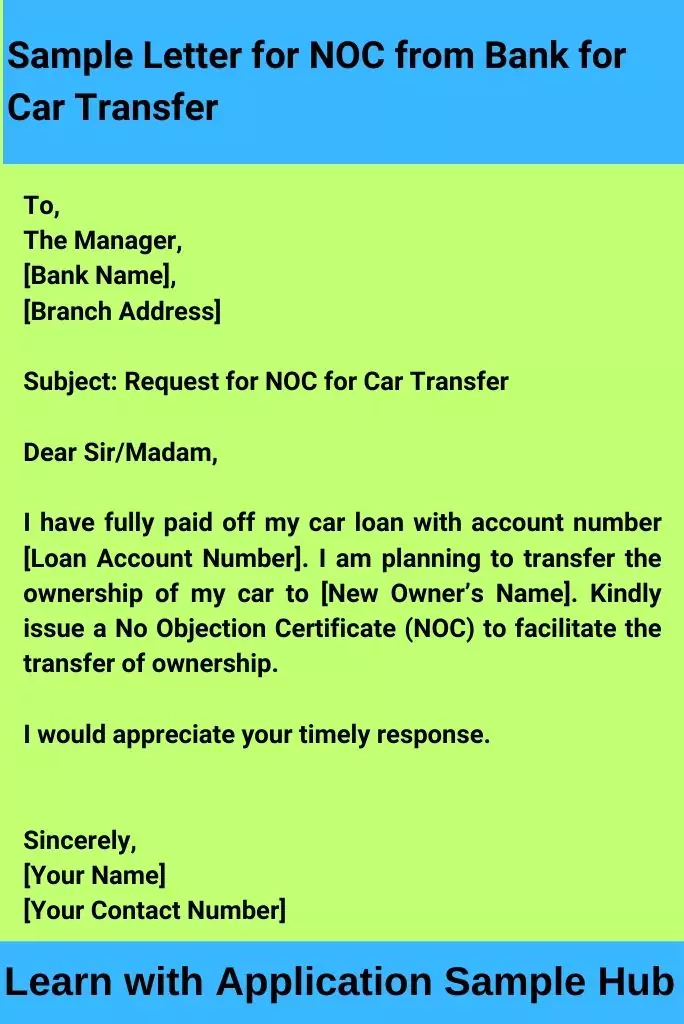

Sample Letter for NOC from Bank for Car Transfer

When transferring the ownership of a car, you’ll need an NOC from the bank if the car was purchased through a loan. Here’s a sample:

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Request for NOC for Car Transfer

Dear Sir/Madam,

I have fully paid off my car loan with account number [Loan Account Number]. I am planning to transfer the ownership of my car to [New Owner’s Name]. Kindly issue a No Objection Certificate (NOC) to facilitate the transfer of ownership.

I would appreciate your timely response.

Thank you,

Sincerely,

[Your Name]

[Your Contact Number]

How to Write an Application for NOC from Bank

Writing an application for NOC from the bank is a straightforward process. To ensure your request is processed efficiently, follow these steps:

- Address the Manager: Always start by addressing the branch manager or relevant bank official.

- State the Purpose: Mention the reason for requesting the NOC, such as loan clearance, vehicle transfer, etc.

- Provide Loan or Account Details: Include all necessary account information, such as your loan account number, the loan type, and the last payment date.

- Polite Closing: End your letter by thanking the manager for their assistance and requesting a prompt response.

Components of a Proper Application

To ensure that your application for a NOC is professional and complete, make sure it includes:

- Addressing the Bank Manager: The application should be addressed to the appropriate person, typically the branch manager.

- Loan or Account Details: Mention your loan account number, name, and branch.

- Clear Purpose: Be specific about why you need the NOC, whether it’s for loan clearance, a vehicle transfer, or another reason.

- Polite Tone: Use a courteous and respectful tone throughout your application.

- Conclusion: Request a prompt response and offer your contact details for any queries.

Structuring the Proper Application Effectively

An effectively structured application for NOC will have:

- Clear Subject: Make the subject of the letter immediately clear, such as “Request for NOC.”

- Loan Details: Provide the details of your loan or account.

- Reason for Request: Clearly state the reason for requesting the NOC.

- Conclusion and Gratitude: Politely request the NOC and thank the manager for their assistance.

FAQs

How long does it take to get an NOC from the bank?

It usually takes between 7-14 business days to receive an NOC after submitting your application, depending on the bank’s process.

Do I need to pay any fees to get a NOC?

Most banks do not charge for issuing an NOC, but it’s always a good idea to confirm this with your bank.

Can I apply for an NOC online?

Some banks allow you to apply for an NOC online through their Internet banking portal, but this depends on the bank’s services.

What documents are required to get an NOC from the bank?

Generally, you’ll need to provide your loan account number, proof of loan repayment, and identification details. Check with your bank for any additional requirements.

Can I get a NOC if I pre-close my loan?

Yes, if you pre-close your loan, the bank will issue an NOC once the loan account is settled.