Keeping your bank account information up-to-date is essential to ensuring smooth transactions and maintaining your account’s security. One of the key requirements for this is the Know Your Customer (KYC) process.

If your KYC details are outdated or incomplete, you may encounter issues with your bank account, including transaction limitations or even account suspension. This is why updating your KYC details in a timely manner is so important.

If you’re unfamiliar with how to apply for a KYC update, don’t worry—this guide is designed to walk you through the entire process. From explaining the concept of KYC to providing step-by-step application samples, you’ll find everything you need to complete your KYC update smoothly.

Whether you’re applying in English or Hindi, or for specific banks like SBI, this guide offers practical tips and ready-to-use formats to make the process as easy as possible.

What is KYC Update in Bank?

KYC, or Know Your Customer, is a process mandated by banks to verify the identity of their customers. It involves providing proof of identity (such as a passport or Aadhaar card), proof of address, and other documents that ensure the bank is aware of its customers’ true identities.

When your details change whether it’s your address, phone number, or identification documents—you need to update your KYC information to ensure that your bank account continues to operate without any issues.

Without proper KYC details, banks may freeze your account or block transactions, as they are legally required to have accurate information about their customers. Hence, updating your KYC information as soon as there’s a change in your details is crucial.

Application for KYC Update in Bank

To request a KYC update, you need to apply to your bank’s branch manager. The application should clearly state your intention to update your KYC information and include details such as your account number, name, and the documents you’re submitting for verification. Below are a few examples of how you can structure an effective KYC update application.

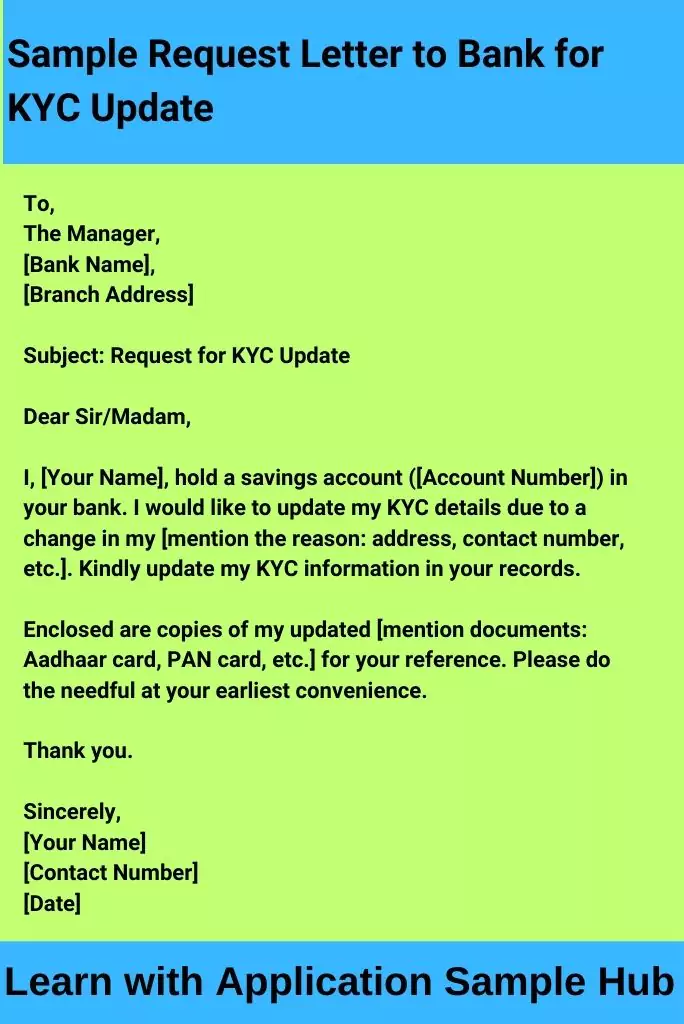

Sample Request Letter to Bank for KYC Update

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Request for KYC Update

Dear Sir/Madam,

I, [Your Name], hold a savings account ([Account Number]) in your bank. I would like to update my KYC details due to a change in my [mention the reason: address, contact number, etc.]. Kindly update my KYC information in your records.

Enclosed are copies of my updated [mention documents: Aadhaar card, PAN card, etc.] for your reference. Please do the needful at your earliest convenience.

Thank you.

Sincerely,

[Your Name]

[Contact Number]

[Date]

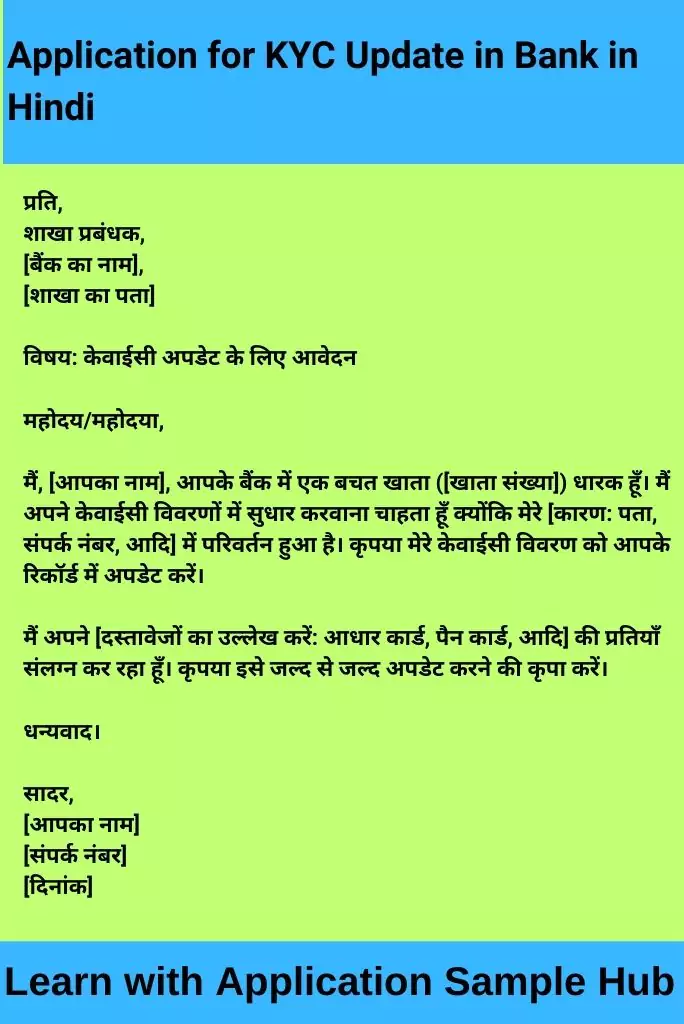

Application for KYC Update in Bank in Hindi

If you prefer to write your application for KYC update in Hindi, here’s a format:

प्रति,

शाखा प्रबंधक,

[बैंक का नाम],

[शाखा का पता]

विषय: केवाईसी अपडेट के लिए आवेदन

महोदय/महोदया,

मैं, [आपका नाम], आपके बैंक में एक बचत खाता ([खाता संख्या]) धारक हूँ। मैं अपने केवाईसी विवरणों में सुधार करवाना चाहता हूँ क्योंकि मेरे [कारण: पता, संपर्क नंबर, आदि] में परिवर्तन हुआ है। कृपया मेरे केवाईसी विवरण को आपके रिकॉर्ड में अपडेट करें।

मैं अपने [दस्तावेजों का उल्लेख करें: आधार कार्ड, पैन कार्ड, आदि] की प्रतियाँ संलग्न कर रहा हूँ। कृपया इसे जल्द से जल्द अपडेट करने की कृपा करें।

धन्यवाद।

सादर,

[आपका नाम]

[संपर्क नंबर]

[दिनांक]

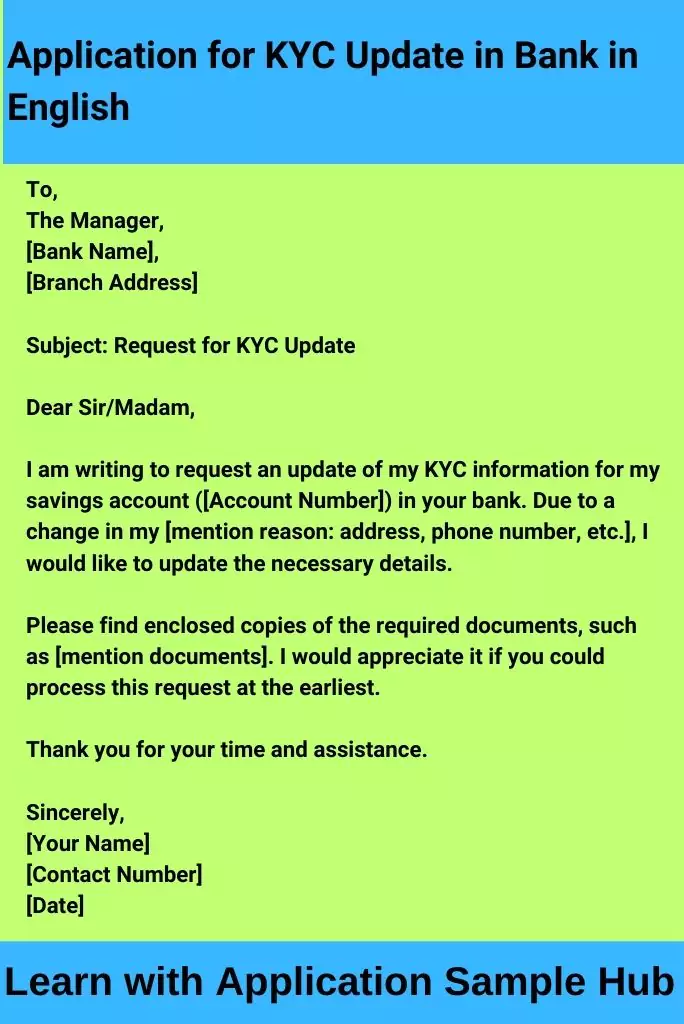

Application for KYC Update in Bank in English

For those who prefer an English format, here’s how to structure it:

To,

The Manager,

[Bank Name],

[Branch Address]

Subject: Request for KYC Update

Dear Sir/Madam,

I am writing to request an update of my KYC information for my savings account ([Account Number]) in your bank. Due to a change in my [mention reason: address, phone number, etc.], I would like to update the necessary details.

Please find enclosed copies of the required documents, such as [mention documents]. I would appreciate it if you could process this request as soon as possible.

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Contact Number]

[Date]

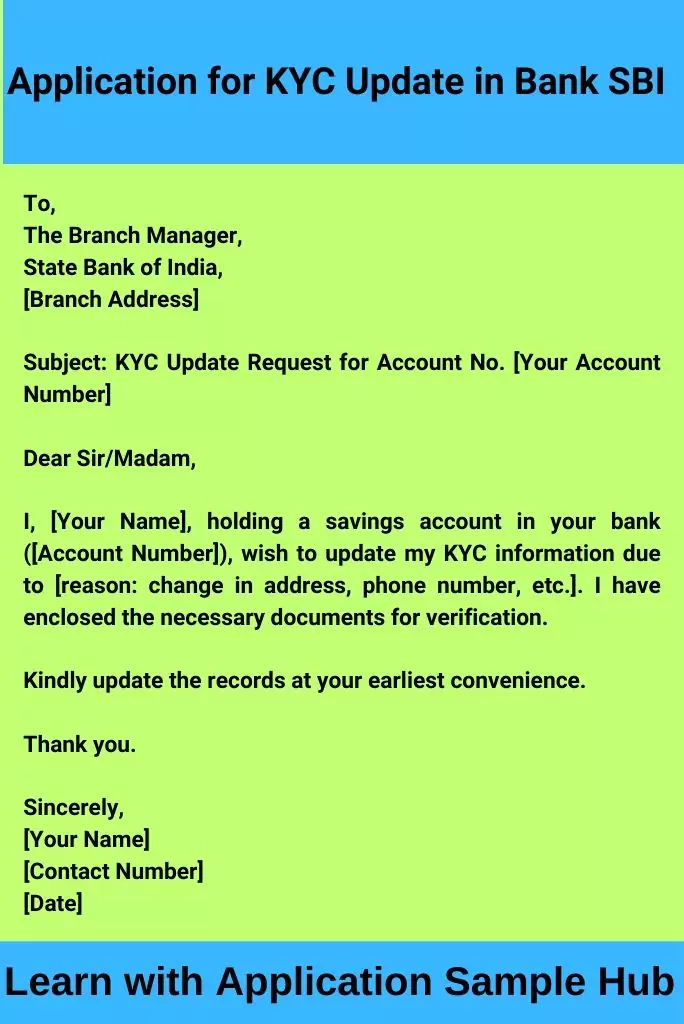

Application for KYC Update in Bank SBI

For State Bank of India (SBI) account holders, here’s a sample KYC update letter format:

To,

The Branch Manager,

State Bank of India,

[Branch Address]

Subject: KYC Update Request for Account No. [Your Account Number]

Dear Sir/Madam,

I, [Your Name], holding a savings account in your bank ([Account Number]), wish to update my KYC information due to [reason: change in address, phone number, etc.]. I have enclosed the necessary documents for verification.

Kindly update the records at your earliest convenience.

Thank you.

Sincerely,

[Your Name]

[Contact Number]

[Date]

How Can I Write a Letter to the Bank for a KYC Update?

Writing a KYC update letter to your bank is straightforward as long as you include all the required information. Your letter should be formal and polite, addressing the branch manager. Make sure to mention your account number, and the reason for the update, and attach the necessary documents (such as ID proof, address proof, etc.).

Here’s a quick checklist of what to include:

- Salutation – Address the branch manager or relevant authority.

- Subject line – Mention “Request for KYC Update.”

- Account Details – Provide your account number for identification.

- Reason for Update – Specify the changes (e.g., new address, updated phone number).

- Enclosed Documents – Mention the attached documents for KYC verification.

- Closing – End with a polite request and your contact information.

Components of a Proper Application

A well-structured application for a KYC update should include the following components:

- Clear Heading: The purpose of the letter (KYC Update Request).

- Personal Information: Your name, account number, and contact information.

- Reason for Update: Mention why you need the KYC update (change in address, phone number, etc.).

- List of Documents: Specify the documents you’re submitting for verification.

- Polite Closing: Request for timely processing and express gratitude.

Structuring the Proper Application Effectively

To structure your application effectively, follow these steps:

- Start with a formal greeting: Address the bank manager or relevant officer.

- Clearly state your purpose: Mention that the letter is a request for a KYC update.

- Include essential details: Provide your account number and the reason for the update.

- Attach supporting documents: Mention what documents are being submitted.

- End politely: Close the letter with a request for prompt action.

FAQs

Why is KYC important in banking?

KYC ensures that banks verify the identity of their customers, which helps prevent fraudulent activities and ensures that financial transactions are secure.

How often should KYC be updated?

KYC details should be updated whenever there’s a significant change in your personal information, such as a change of address or phone number.

What documents are required for KYC update?

Typically, proof of identity (such as an Aadhaar card or passport) and proof of address are required for a KYC update.

Can I update my KYC online?

Yes, many banks offer online KYC update options through their mobile apps or websites, but it depends on your bank’s policies.

What happens if I don’t update my KYC?

Failure to update KYC details may result in restrictions on your account, such as limits on transactions or even suspension of the account.